An Environmental Tax Reform (ETR) consists in transitioning the national taxation system from current pre-existing taxes on labor (personal income tax and social contributions), capital and consumption (VAT and other indirect taxes) to consumption and production activities that generate environmental pressures, without affecting the overall government revenues coming from taxation. This shift could provide better signals to economic agents and therefore, leading to a better functioning of markets. In a more general way, an Environmental Fiscal Reform (EFR) also includes the elimination of environmental harmful subsides.

But what would happen with the economic costs of such a reform? As stated in previous posts, the ‘double dividend hypothesis’ suggests that introducing environmental taxes and, at the same time using its revenues to reduce other taxes not only reduces environmental problems but also has a positive impact on the economy, if maintaining a constant level of total revenue and/or government expenditure. We showed a double dividend is possible by introducing a carbon tax, but what if we consider a broader fiscal reform?

Two big questions arise here: (1) Can an EFR be effective in terms of reduction of environmental loads? (2) Can an EFR trigger economic benefits (or at least no costs) if revenues from the reform are wisely used?

We used the dynamic computable general equilibrium model developed for the Spanish economy in the context of the METRES project, in order to test the double dividend hypothesis of an EFR. The model includes a sub-model describing the energy use and the emissions of 31 different pollutants. The EFR we simulated included adding/increasing a tax on 39 different industry outputs (out of 101 industries we detailed in our model), as well as reducing/eliminating subsides in the same industries. Specifically, this new tax would represent a 20% of total industry output, and subsides would be reduced by 20% of their total output too. Levied industries are related to energy sectors, water supply, sale of motor vehicles, water and air transport and waste treatment activities.

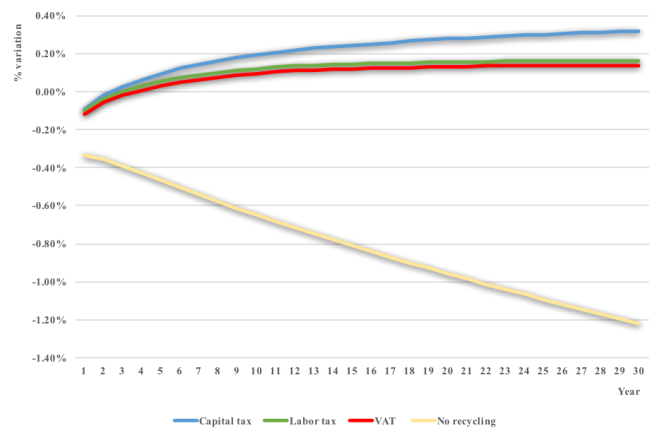

We set four different scenarios, related to revenue recycling: a reduction of taxes on capital, a reduction of taxes on labor, a reduction of value added taxes, and a scenario where revenues are not recycled, so there is more government spending. Environmental impacts are shown in figure 1 and economic effects in figure 2.

Fig. 1. Average annual percentage variation of different pollutant emissions under an EFR.

Fig. 1. Average annual percentage variation of different pollutant emissions under an EFR.

Fig. 1. Percentage variation of GDP of an EFR under different tax recycling scenarios.

GDP is higher than the base case after the 3-4th year of implementation when revenues are used to reduce other taxes. All revenue recycling options provide economic and environmental benefits, suggesting that the ‘double dividend’ can be achieved.

A full article, describing the model, more results and implications of the research, have been prepared and will be soon submitted to a scientific Journal.

Happy Thanksgiving from Harvard!

[…] Podeu llegir les novetats del projecte i el darrer post al següent enllaç. […]

Me gustaMe gusta

[…] of different possible taxes on other externalities, pollutants or resources. Beyond this, an Environmental Fiscal Reform has also been analyzed by levying several industries related to energy, transport, water and waste, […]

Me gustaMe gusta

[…] Moreover, even in the less likely case of no energy transition, the reform can include a reform in the use of the revenues from these taxes. If they are used to reduce other pre-existing taxes, like labor, capital or consumption taxes a double dividend is achievable as we demonstrated in previous research. […]

Me gustaMe gusta

[…] had the opportunity to present some of the results of the METRES project to the plenary audience and in a poster. Specifically, those related to the achievability of a […]

Me gustaMe gusta